Ready to simplify your tax business?

Transform how you manage clients and communication with DominiqueAI’s all-in-one automation system.

Grow Your Tax Business With DominiqueAI

DominiqueAI makes it easy to manage your business, stay connected with your clients, and deliver a year around support experience before and after tax season.

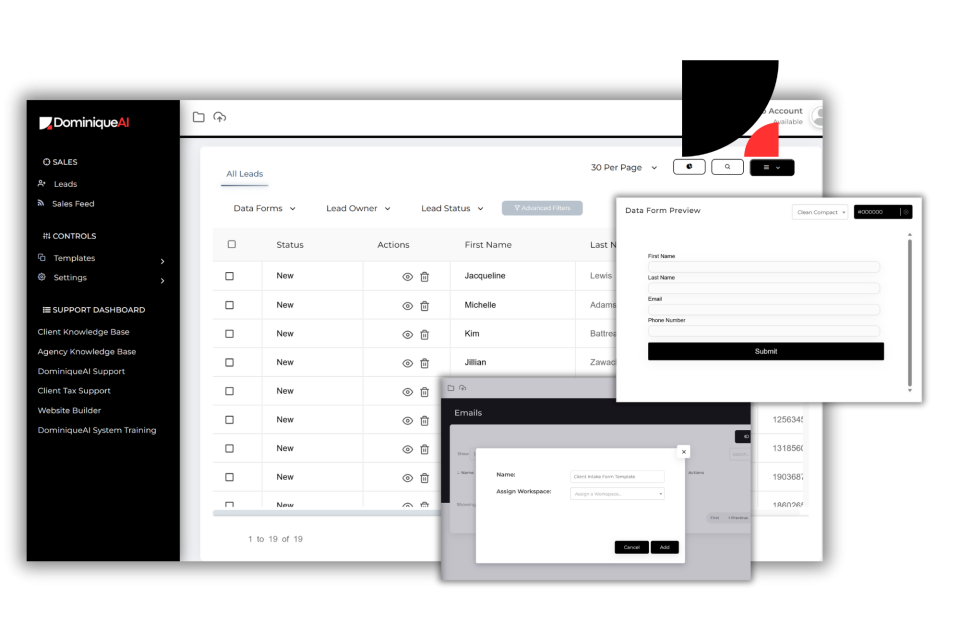

CRM Solution

Manage all your clients, leads, and communication in one organized place to keep your tax business running smoothly.

Email Automation

Send follow ups, reminders, and updates automatically so you stay connected without doing the work manually.

365 Client Support

Give your clients fast answers anytime through built-in AI voice and chat support available all year long.

What You Can Ask DominiqueAI

Whether you’re a client with tax questions or a professional needing quick IRS updates, DominiqueAI delivers accurate answers 24/7. From credits and deductions to filing rules and deadlines, it’s your trusted resource for instant answers and support.

Child Tax Credit Qualification

Call to check eligibility, amounts, and how much you may receive per child.

Refund Status & Timing

Find out how long refunds take with e-file and direct deposit.

Dependents & Household Status

Ask who qualifies as a dependent and which filing status applies.

Available Education Credits

Get guidance on saving money with tuition credits and deductions.

Homeownership Benefits

Learn what mortgage interest, property taxes, and points you can deduct.

Small Business Deductions

Discover what everyday expenses you may be able to write off.

Standard vs Itemized Deductions

Stay updated on 2024 deduction amounts and when itemizing pays off.

W-2 & 1099 Filing

Review IRS requirements for clients with both employee and contractor income.

Self-Employment Taxes

Check the current self-employment tax rate and deductible percentage.

Education Credits

Understand differences between the American Opportunity and Lifetime Learning credits.

Filing Deadlines & Extensions

Confirm upcoming IRS due dates and extension rules for individuals and businesses.

IRS Tax Law Updates

Access the latest definitions, guidelines, and state-specific tax law changes.

Your Taxes. Your Language.

From English to Spanish and beyond, DominiqueAI ensures clients and tax pros feel understood in the language that matters most.

Experience How DominiqueAI Handles Real Conversations

Listen to real examples of DominiqueAI helping clients through voice calls. Each call shows how our system makes communication easier, faster, and more reliable for both tax professionals and their clients.

Key Benefits for Tax Professionals

DominiqueAI gives tax professionals unlimited potential to engage clients, expand services, and strengthen relationships, all while saving time and boosting revenue.

24/7 Availability

Serve clients day or night never miss a call, text, or chat again.

Boost Productivity

Automate routine support so you can focus on high-value filings and strategy.

Scale Without Extra Staff

Handle more clients without increasing payroll or overhead.

Stronger Client Relationships

Clients feel supported, informed, and confident in your expertise.

Call Transfer & Tracking

Seamlessly transfer calls, track histories, and keep communication organized.

Peace of Mind

Know that your clients always have answers, even when you’re unavailable.

DominiqueAI delivers the power of automation, intelligent support, and a user-friendly interface to help tax professionals manage their business more efficiently.

By combining AI technology with custom form builders, integrated email tools, and automated workflows, DominiqueAI eliminates repetitive tasks and reduces response times so you can focus on serving clients, not managing chaos.

DominiqueAI CRM Features

DominiqueAI streamlines how you communicate, onboard, and support your clients. With smart automation, customizable forms, and real-time support tools, you can deliver faster responses, better experiences, and lasting client satisfaction year-round.

UNLIMITED EMAILS

Send as many messages as you need with no limits. Stay connected and follow up with every client easily.

UNLIMITED WORKFLOWS

Automate your daily tasks with flexible workflows that help manage client communication and business operations.

UNLIMITED CONTACTS

Manage every client, lead, and prospect in one organized space with no contact limits or storage restrictions.

UNLIMITED DATA FORMS

Create digital intake and feedback forms to collect, organize, and process client information seamlessly.

UNLIMITED CALENDARS

Schedule appointments, track meetings, and stay organized across all teams with synced online calendars.

EMAIL AUTOMATION

Send messages automatically based on client actions, reminders, or updates to save time and build consistency.

EMAIL TEMPLATES

Use prebuilt templates for common tax communications to respond faster and keep your brand consistent.

TAX WEBSITE TEMPLATE

Launch a professional tax website that highlights your services, builds credibility, and attracts new clients.

TEAM MANAGEMENT

Assign roles, monitor performance, and collaborate efficiently with team access and user permissions.

OPPORTUNITY TRACKING

Track new leads, monitor progress, and follow up on potential clients with built-in opportunity pipelines.

INVOICE BUILDER

Create, send, and manage professional invoices directly inside the platform to simplify client billing.

QR CODE BUILDER

Generate custom QR codes to link forms, websites, and marketing pages for faster client engagement.

Testimonials

See how tax professionals and service bureaus are transforming their client experience with DominiqueAI. Real stories, real results, and real impact.

"As a one-person office, I used to miss calls constantly during tax season. With DominiqueAI, my clients get answers right away and I don’t lose business when I’m busy. It feels like I finally have a reliable assistant — without the overhead."

Maria H.

Independent Tax Preparer

"Our bureau manages multiple tax preparers, and DominiqueAI has been a game changer. Clients get instant answers about credits, refunds, and deadlines, while our team gets updates straight from the IRS. It’s like having another team member working around the clock."

David P

Service Bureau Owner

"DominiqueAI has completely transformed how we engage clients. We’ve reduced no-shows, captured more leads, and built stronger client trust because support is available 24/7. It’s not just software — it’s a true partner in growing our agency."

Sharon L

Tax Agency Director

Choose a plan that's right for you

Every DominiqueAI plan comes with a built-in IRS.gov knowledge base that makes finding answers fast and simple. Tax professionals and their clients can access accurate, up-to-date information directly through the system,

Growth

$324/Year

Ideal for solo preparers in need of an affordable automation system.

Klarna payment option available.

Pro

$564/Year

Ideal for growing agencies that need advanced client engagement.

Klarna payment option available.

Expert

$1164/Year

Ideal for well established agencies with high support engagement requirements.

Klarna payment option available.

Enterprise

Ideal for large teams, businesses and agencies

Our Enterprise plan is built for agencies and large service bureaus that need more than just automation, they need a customized AI partner. With unlimited assistants, white-label options, and advanced integrations, this plan adapts to your business at scale.

All plans include unlimited automation workflows, leads and emails using Google, Outlook or your own SMTP.

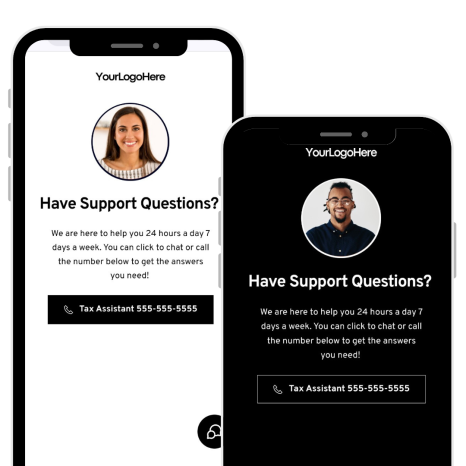

No Website, No Problem.

Every plan includes a complimentary AI Support page. This page is designed to give your clients easy access to helpful resources, and answers, helping you deliver the world-class support they deserve.

Client Support Page

By entering this website, you agree to our Terms & Conditions

Frequently Asked Questions

Choose a plan that best fits your needs and grow on the back of winning content.

What is a client profile ?

A client profile is like a smart library of information that DominiqueAI uses to answer questions. It combines trusted IRS resources with your agency’s own updates, so clients and tax professionals always get clear, accurate answers 24/7.

What information can be added to a client profile ?

A client profile can include IRS tax laws, common client questions, definitions of tax terms, filing procedures, and even your agency’s own policies or updates. This way, DominiqueAI can give accurate answers that fit both IRS rules and your office’s workflow.

What is client profile processing time?

This is the amount of time it takes for updates you provide to show up in DominiqueAI’s system. This only applies to the information you add, not IRS rules or other sources.

What information can I add to my client's profile?

You can add information that helps DominiqueAI answer client-specific return questions, such as refund status, filing deadlines, required documents, prior-year return details, or what forms were submitted. This makes it easier for clients to get quick, accurate updates about their own tax return while still aligning with your agency’s process.

Based on my plan, how often can I submit client profile requests?

There’s no cap on how many client profile requests you can submit. No matter your plan, you can send updates anytime and they’ll be processed into DominiqueAI.

How does DominiqueAI Chat integrate with my website?

Once your account is ready, we’ll email you an embeddable code that lets you add the DominiqueAI chat widget directly to your website. If you don’t have a website, no problem, you can choose from three free support page templates where your chat widget can be hosted and shared with clients.

Contact Us

Hello, there! We’ll be glad to here from you.

Drop your inquiry below and one of our team members will reply back as soon as possible.

Phone

Address